We make it simple. With a Model Wealth Portfolio, our clients benefit from a process-oriented approach to align their unique investment goals with their customized portfolio.

- Model Wealth Portfolios

- Buy & Sell Stocks

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss.

Uses the intelligence of an online portfolio manager combined with personal assistance and support from a financial consultant. Learn More

Guided Wealth Portfolios (GWP) is a centrally managed, algorithm-based, investment program sponsored by LPL Financial LLC (LPL). GWP uses proprietary, automated, computer algorithms of FutureAdvisor to generate investment recommendations based upon model portfolios constructed by LPL. FutureAdvisor and LPL are nonaffiliated entities. If you are receiving advisory services in GWP from a separately registered investment advisor firm other than LPL or FutureAdvisor, LPL and FutureAdvisor are not affiliates of such advisor. Both LPL and FutureAdvisor are investment advisors registered with the U.S. Securities and Exchange Commission, and LPL is also a Member FINRA/SIPC.

All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Get Started with the Guided Wealth Portfolio.

Guided Wealth Portfolio - Instructional Video

Do you know how much risk is in your portfolio? Find your Risk Number and get your FREE Portfolio Risk Analysis!

Riskalyze is technology that mathematically pinpoints your Risk Number, and aligns a portfolio to match. Riskalyze replaces subjective terms like "conservative" and "aggressive" with the Risk Number, a way for you and your Financial Consultant to establish the correct amount of risk for your investments.

Riskalyze helps us ensure that your portfolio aligns with your investment goals and expectations!

Everyone has a Risk Number. Let's find yours.

Capture Your Risk Number

First, take a five-minute quiz that covers topics such as portfolio size, financial goals and what you're willing to risk for potential gains. We'll then pinpoint Risk Number to guide our decision.

Your Risk Number provided is on a scale of 1 to 99, with higher numbers indicating higher risk tolerance.

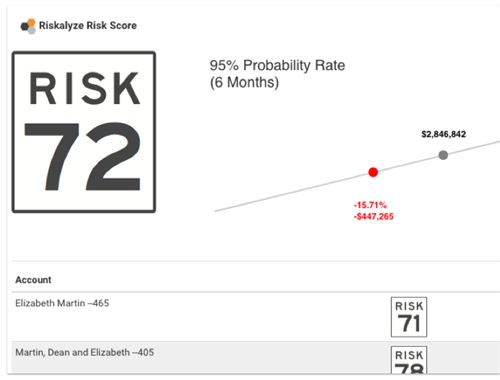

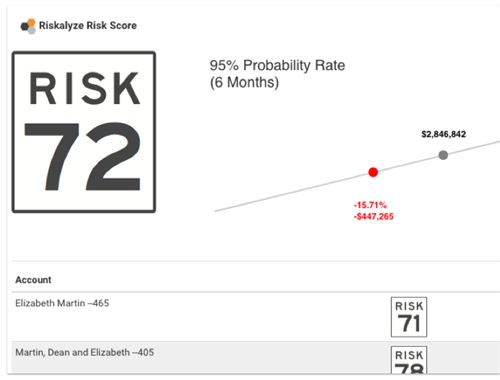

Review Your Current Investments

It turns out 4 out of 5 of people have more risk in their portfolios than they previously realized. Next we will import your current investments to analyze if your current investments are a good fit for your risk tolerance.

Your Risk Number provided is on a scale of 1 to 99, with higher numbers indicating higher risk tolerance. The risk range shown describes the comfort zone for your investments. Over the next six months, it represents a hypothetical target that you would prefer to keep your investments within. Using the hypothetical example shown, this would mean the investor would be comfortable risking a loss of -10% or $-103,500 in exchange for the chance of making a gain of +21% or $207,000. There is no guarantee any investments would perform within the range.

Align Your Portfolio to Match

After pinpointing your Risk Number, we’ll craft a portfolio that aligns with your personal preferences and priorities, allowing you to feel comfortable with your expected outcomes.

The resulting proposed portfolio will include projections for the potential gains and losses we should expect over time.

*1 Your Risk Number provided is on a scale of 1 to 99, with higher numbers indicating higher risk tolerance.

*2 Your Risk Number provided is on a scale of 1 to 99, with higher numbers indicating higher risk tolerance. The risk range shown describes the comfort zone for your investments. Over the next six months, it represents a hypothetical target that you would prefer to keep your investments within. Using the hypothetical example shown, this would mean the investor would be comfortable risking a loss of -10% or $-103,500 in exchange for the chance of making a gain of +21% or $207,000. There is no guarantee any investments would perform within the range.